EverSafe Newsletter

SENIOR FINANCIAL PROTECTION NEWS

Providing thought-provoking articles, commentary and general information on issues related to aging and financial health.

Banks & Firms Focusing on Elder Fraud

EVERSAFE CITED IN FORBES & AMERICAN BANKER

Americans over the age of 50 now account for a third of the US population. They also hold 70% of bank deposits, according to a recent piece in the Wall Street Journal. The 24,454 cases of elder fraud reported in 2018 is a number that is 12%  higher than 2017 and is nearly double the number from 2013. As Richard Eisenberg outlined in an article for Forbes’ Next Avenue, this fact is not wasted on the regulators—or the financial services industry. Many banks, investment firms, and credit unions are developing fraud and risk strategies to address issues related to vulnerable customers. The Senior Safe Act encourages financial institutions to report cases of suspected exploitation of vulnerable individuals and offers limited liability when they do so, as long as they also provide training to their employees about the ‘red flags’ of elder financial abuse. The piece also highlights the new FINRA Rules, one of which requires broker dealers to take steps to obtain the name of a ‘trusted contact’ when accounts are opened. This designated individual would serve as a contact whom the advisor could reach out to—in cases of suspected exploitation. The Forbes Next Avenue piece quotes Liz Loewy, COO of EverSafe, who suggested that a ‘trusted contact’ could actually be a lifesaver—if they were also willing to receive alerts as to irregular activity on the investor’s accounts.

higher than 2017 and is nearly double the number from 2013. As Richard Eisenberg outlined in an article for Forbes’ Next Avenue, this fact is not wasted on the regulators—or the financial services industry. Many banks, investment firms, and credit unions are developing fraud and risk strategies to address issues related to vulnerable customers. The Senior Safe Act encourages financial institutions to report cases of suspected exploitation of vulnerable individuals and offers limited liability when they do so, as long as they also provide training to their employees about the ‘red flags’ of elder financial abuse. The piece also highlights the new FINRA Rules, one of which requires broker dealers to take steps to obtain the name of a ‘trusted contact’ when accounts are opened. This designated individual would serve as a contact whom the advisor could reach out to—in cases of suspected exploitation. The Forbes Next Avenue piece quotes Liz Loewy, COO of EverSafe, who suggested that a ‘trusted contact’ could actually be a lifesaver—if they were also willing to receive alerts as to irregular activity on the investor’s accounts.

A February article in American Banker also focused on how banks and firms are viewing new solutions for preventing elder fraud, including the role that technology can play in identifying clients with diminished capacity. The piece cites Larry![]() Santucci, from the Federal Reserve Bank in Philadelphia, who underscores the importance of Artificial Intelligence—and services like EverSafe—to identify signs suggesting that a customer is at risk. ”What is needed, Santucci argues, are programs that can compute the probability that a person will be involved in a fraudulent scam or financially exploited.” Santucci referenced “EverSafe as one example of AI-based software that can detect “diminished financial capacity,” a loss of executive function that prevents you from performing your day-to-day banking tasks.” Clearly, elder fraud prevention is now a front and center issue for financial services professionals.

Santucci, from the Federal Reserve Bank in Philadelphia, who underscores the importance of Artificial Intelligence—and services like EverSafe—to identify signs suggesting that a customer is at risk. ”What is needed, Santucci argues, are programs that can compute the probability that a person will be involved in a fraudulent scam or financially exploited.” Santucci referenced “EverSafe as one example of AI-based software that can detect “diminished financial capacity,” a loss of executive function that prevents you from performing your day-to-day banking tasks.” Clearly, elder fraud prevention is now a front and center issue for financial services professionals.

LEGISLATIVE / GOVERNMENT UPDATE & SCAM ALERT

FTC Study finds that Romance Scams Rank No 1 in Total Losses to Victims

FTC Study finds that Romance Scams Rank No 1 in Total Losses to Victims. According to the report, in 2018 the FTC “Sentinel had more than 21,000 reports about romance scams, and people reported losing a total of $143 million—that’s more than any other consumer fraud…” The average reported loss to romance scams was $2600. And not surprisingly, seniors are more likely to fall prey. Individuals age 40 to 69 reported losing money to romance scams at the highest rates, “more than twice the rate of people in their 20s.” Seniors should be educated about the prevalence of romance scams, which often originate on social media sites. The

FTC Study finds that Romance Scams Rank No 1 in Total Losses to Victims. According to the report, in 2018 the FTC “Sentinel had more than 21,000 reports about romance scams, and people reported losing a total of $143 million—that’s more than any other consumer fraud…” The average reported loss to romance scams was $2600. And not surprisingly, seniors are more likely to fall prey. Individuals age 40 to 69 reported losing money to romance scams at the highest rates, “more than twice the rate of people in their 20s.” Seniors should be educated about the prevalence of romance scams, which often originate on social media sites. The  importance of financial monitoring cannot be overstated. According to a recent AARP survey, 27% of adults say that they, a family member, or a friend have encountered attempted financial scams while seeking friendship or romance online. As expected, the survey found that those who had been targeted or victimized had more often experienced feelings of social isolation than those who had not. AARP’s Fraud Watch Network has launched an educational campaign to raise awareness of online-based relationship fraud schemes. Reports concerning suspected romance scams should be reported to FTC.gov/complaint.

importance of financial monitoring cannot be overstated. According to a recent AARP survey, 27% of adults say that they, a family member, or a friend have encountered attempted financial scams while seeking friendship or romance online. As expected, the survey found that those who had been targeted or victimized had more often experienced feelings of social isolation than those who had not. AARP’s Fraud Watch Network has launched an educational campaign to raise awareness of online-based relationship fraud schemes. Reports concerning suspected romance scams should be reported to FTC.gov/complaint.Fraud Prevention Resource Website

DOJ ELDER JUSTICE WEBSITE—RESOURCES FOR VICTIMS & PROFESSIONALS

The Department of Justice has made financial crime prevention against older Americans one of its top priorities. A website on elder justice now includes information about different types of financial scams, Adult Protective Services (including a link to find the local contacts for reporting cases in your area), and other helpful resources. A relevant source for seniors, caregivers, and professionals, the website even provides a helpful video for bank tellers on how to identify potential cases of elder financial abuse.

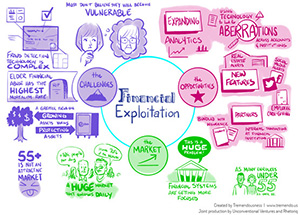

EverSafe Featured in Podcast Focused on Tech & Financial Health

BEYOND KILLER ROBOTS:

BEYOND KILLER ROBOTS:

USING AI FOR FINANCIAL FRAUD PREVENTION

Theodora Lau, Founder of Unconventional Ventures and an expert and thought leader on fintech, interviewed Liz Loewy of EverSafe in a podcast called Shades of Grey. Her corresponding infographic and blog piece on how financial institutions and fintech can leverage technology to address the elder fraud crisis can be found here.

William Webster Targeted in Phone Scam

FRAUDSTER ATTEMPTS TO EXTORT FORMER FBI & CIA CHIEF

94-year-old William Webster, a former director of the FBI and the CIA, was the intended  victim of a garden-variety telephone scam. The fraudster, Keniel Thomas, 29, from Jamaica, pleaded guilty and was given a jail sentence in early February. In Thomas’ call to Webster, he said that he was the head of the Mega Millions lottery and that Webster had won $15 million and a Mercedes Benz. The condition, characteristic in ‘advance fee’ scams, was that Webster would have to pay $50 thousand in advance to cover taxes on the award. Webster’s old agency was notified and the FBI recorded follow-up calls with Webster. It wasn’t long before federal authorities learned the scammer’s identity, and Thomas was arrested at JFK Airport. Webster’s wife, speaking to NBC News, stated: “Everybody’s vulnerable, every grandmother, every grandfather.”

victim of a garden-variety telephone scam. The fraudster, Keniel Thomas, 29, from Jamaica, pleaded guilty and was given a jail sentence in early February. In Thomas’ call to Webster, he said that he was the head of the Mega Millions lottery and that Webster had won $15 million and a Mercedes Benz. The condition, characteristic in ‘advance fee’ scams, was that Webster would have to pay $50 thousand in advance to cover taxes on the award. Webster’s old agency was notified and the FBI recorded follow-up calls with Webster. It wasn’t long before federal authorities learned the scammer’s identity, and Thomas was arrested at JFK Airport. Webster’s wife, speaking to NBC News, stated: “Everybody’s vulnerable, every grandmother, every grandfather.”