Scam Alert: AT&T Breach Affects 70 million

COMPANY NOW FACING CLASS ACTION LAWSUITS

Last month, AT&T reported that more than 70 million current and former customers had their account data and personal identifying information compromised in a massive breach. Nearly half the number of consumers affected by the Equifax breach have now been affected, with the exposure of one or more of the following: full name, email address, phone number, Social  Security number, date of birth, and AT&T account information, including passcodes. A number of class action lawsuits have been filed against AT&T, alleging that the breach was a “direct result” of their failure to implement adequate and reasonable cybersecurity procedures and protocols. One of the suits alleges that despite notifying its customers around March 31 of the breach, AT&T failed to provide critical information, such as “when it occurred and when it was investigated.” The complaint also asserts that the company should have provided an explanation to its current and former customers as to why they weren’t informed about the breach in a more timely fashion. In light of the number of American consumers affected, we are reminding EverSafe members and their designated trusted advocates to keep a close eye on their alerts. And members who are interested in adding a loved one to their current EverSafe subscription can do so at a 25% discount by logging in, and selecting Settings – Manage Subscription – Add Family Members. Any questions should be directed to CustomerCare@EverSafe.com or call 888-575-3837.

Security number, date of birth, and AT&T account information, including passcodes. A number of class action lawsuits have been filed against AT&T, alleging that the breach was a “direct result” of their failure to implement adequate and reasonable cybersecurity procedures and protocols. One of the suits alleges that despite notifying its customers around March 31 of the breach, AT&T failed to provide critical information, such as “when it occurred and when it was investigated.” The complaint also asserts that the company should have provided an explanation to its current and former customers as to why they weren’t informed about the breach in a more timely fashion. In light of the number of American consumers affected, we are reminding EverSafe members and their designated trusted advocates to keep a close eye on their alerts. And members who are interested in adding a loved one to their current EverSafe subscription can do so at a 25% discount by logging in, and selecting Settings – Manage Subscription – Add Family Members. Any questions should be directed to CustomerCare@EverSafe.com or call 888-575-3837.

Has Retirement Gone Out of Style?

MORE SENIORS PLAN TO KEEP WORKING

One out of four Americans, 50 and over, say they expect to keep working and never retire, according to an AARP survey published earlier this month. The research attributes the development to seniors’ concerns about the economy and their lack of retirement savings. Although many of us believe that we should have about $1.46 million put away to retire comfortably, most Americans have saved less than $89,000, on average, according to a Northwestern Mutual study. Financial professionals also identify another reason for the changing landscape of retirement: entrepreneurship. According to Pacific Investment Research, jobs have become more flexible, which makes the prospect of working later in life more attractive. Individuals who might have once been expected to retire are “pursuing new careers, changing industries, founding companies, or staying on at their current firm in a different capacity.”

One out of four Americans, 50 and over, say they expect to keep working and never retire, according to an AARP survey published earlier this month. The research attributes the development to seniors’ concerns about the economy and their lack of retirement savings. Although many of us believe that we should have about $1.46 million put away to retire comfortably, most Americans have saved less than $89,000, on average, according to a Northwestern Mutual study. Financial professionals also identify another reason for the changing landscape of retirement: entrepreneurship. According to Pacific Investment Research, jobs have become more flexible, which makes the prospect of working later in life more attractive. Individuals who might have once been expected to retire are “pursuing new careers, changing industries, founding companies, or staying on at their current firm in a different capacity.”

TREASURY FOCUSES ON ELDER FINANCIAL EXPLOITATION

On April 18th, the Financial Crimes Enforcement Network (FinCEN) of the US Treasury issued an analysis on elder financial exploitation. As banking professionals know, financial institutions are required to report suspected cases of financial abuse to  FinCEN in a document called a Suspicious Activity Report (SAR), which contains a flag box for elder financial exploitation. The most recent FinCEN analysis reported that from 2022 to 2023, approximately $27 billion in suspicious activity related to older customers. For purposes of the analysis, FinCEN distinguished between what they called “elder theft” cases, in which the victim knows the offender, and “elder scams,” where the perpetrator is a stranger. In the cases that were identified by financial institutions and then reported to FINCEN, elder scams accounted for 80% of illicit activity. This finding contrasts with a number of studies, based on self-reported elder financial abuse in which the largest percentage of exploiters are family members of the older victim. At any rate, “FinCEN’s analysis highlights the critical role of financial institutions in helping to identify, prevent, and report suspected elder financial exploitation,” according to the head of FinCEN, Andrea Gacki.

FinCEN in a document called a Suspicious Activity Report (SAR), which contains a flag box for elder financial exploitation. The most recent FinCEN analysis reported that from 2022 to 2023, approximately $27 billion in suspicious activity related to older customers. For purposes of the analysis, FinCEN distinguished between what they called “elder theft” cases, in which the victim knows the offender, and “elder scams,” where the perpetrator is a stranger. In the cases that were identified by financial institutions and then reported to FINCEN, elder scams accounted for 80% of illicit activity. This finding contrasts with a number of studies, based on self-reported elder financial abuse in which the largest percentage of exploiters are family members of the older victim. At any rate, “FinCEN’s analysis highlights the critical role of financial institutions in helping to identify, prevent, and report suspected elder financial exploitation,” according to the head of FinCEN, Andrea Gacki.

Coffee Grounds and Brain Health?

NEW RESEARCH FINDS PROMISE

The positive health effects of drinking coffee have been investigated in a number of recent studies. New research from the University of Texas at El Paso suggests that a compound present in used coffee grounds may help protect the brain  from neurodegenerative disorders, including Alzheimer’s and Parkinson’s disease. The study concludes that “caffeic-acid based Carbon Quantum Dots (CACQDs), which can be derived from spent coffee grounds, have the potential to protect brain cells from the damage caused by several neurodegenerative diseases − if the condition is triggered by factors such as obesity, age and exposure to pesticides and other toxic environmental chemicals.” The research also advises that the grounds may even “inhibit the aggregation of amyloid protein fragments” in the brain – a hallmark of Alzheimer’s type dementia. But don’t sprinkle coffee grounds on your food just yet! The study’s authors caution that further observational and clinical studies in humans (as opposed to in vitro) are warranted to examine the effects of the different compounds found in the spent grounds.

from neurodegenerative disorders, including Alzheimer’s and Parkinson’s disease. The study concludes that “caffeic-acid based Carbon Quantum Dots (CACQDs), which can be derived from spent coffee grounds, have the potential to protect brain cells from the damage caused by several neurodegenerative diseases − if the condition is triggered by factors such as obesity, age and exposure to pesticides and other toxic environmental chemicals.” The research also advises that the grounds may even “inhibit the aggregation of amyloid protein fragments” in the brain – a hallmark of Alzheimer’s type dementia. But don’t sprinkle coffee grounds on your food just yet! The study’s authors caution that further observational and clinical studies in humans (as opposed to in vitro) are warranted to examine the effects of the different compounds found in the spent grounds.

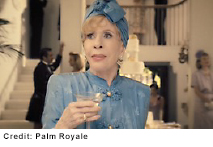

Carol Burnett

NATIONAL TREASURE TURNS 91

How many performers can tout a 68-year career as an actor, singer, comedian, and national treasure? Carol Burnett can, and the iconic entertainer is still going strong. Carol starred in one of the most successful comedy shows in television history, The Carol Burnett Show, which received

How many performers can tout a 68-year career as an actor, singer, comedian, and national treasure? Carol Burnett can, and the iconic entertainer is still going strong. Carol starred in one of the most successful comedy shows in television history, The Carol Burnett Show, which received  23 Emmy awards over the course of its run. And even now, in her ninth decade, Carol stars in the popular Apple TV series Palm Royale, alongside younger stars Kristen Wiig and Laura Dern. Carol just celebrated her 91st birthday with an appearance on the Jimmy Kimmel Live! Show. After joking that she has a crush on Bradley Cooper, the late-night host surprised her with a video from the actor – who let Carol know that her feelings of admiration are mutual.

23 Emmy awards over the course of its run. And even now, in her ninth decade, Carol stars in the popular Apple TV series Palm Royale, alongside younger stars Kristen Wiig and Laura Dern. Carol just celebrated her 91st birthday with an appearance on the Jimmy Kimmel Live! Show. After joking that she has a crush on Bradley Cooper, the late-night host surprised her with a video from the actor – who let Carol know that her feelings of admiration are mutual.