A financial safety net

for peace of mind.

EverSafe© alerts you and your loved ones

to threats that put your life savings at risk.

All-in-one protection against

scams, fraud & identity theft.

24/7 US based human support:

Real people with real solutions.

Smart alerts for you and your loved ones

- Scams, fraud, and identity theft

- Newly issued credit cards, bank accounts, or loans

- Missing regular deposits

- Use of dormant credit cards

- Suspicious bank, investment & retirement activity

- Real estate title changes/new liens

… and more

Has your private information been exposed online?

Try our free scan to see what we can find.

Keep an eye on your loved one’s bills

- Unauthorized charges

- Upcoming/late bills

- Increases in recurring bills

- Solicitations from ‘charity’ ventures

- Double payments

- Changes in spending & cash usage

- Account balances, all in one place

…and so much more

Round-the-clock support because

problems can’t always wait till morning.

We’re experts in fraud remediation

& Identity Theft.

“I signed my mom up for EverSafe to keep an eye on her finances. It helps me identify surprising issues where she has made mistakes, including paying bills twice. At the same time that I signed up my mother, I enrolled myself. Recently, I fell for a scam over the phone and EverSafe helped me take care of the situation the very same night.”

– G. O

Who We Serve

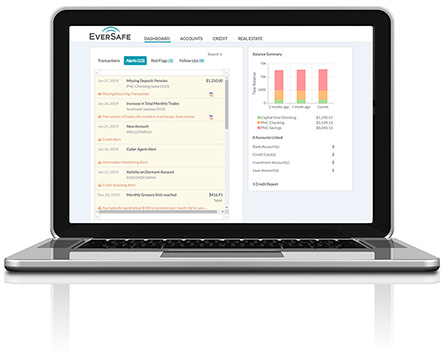

EverSafe® monitors bank and investment accounts, credit cards, credit data, and real estate for you and your family. Our alerts are designed with seniors in mind.

Protect Yourself

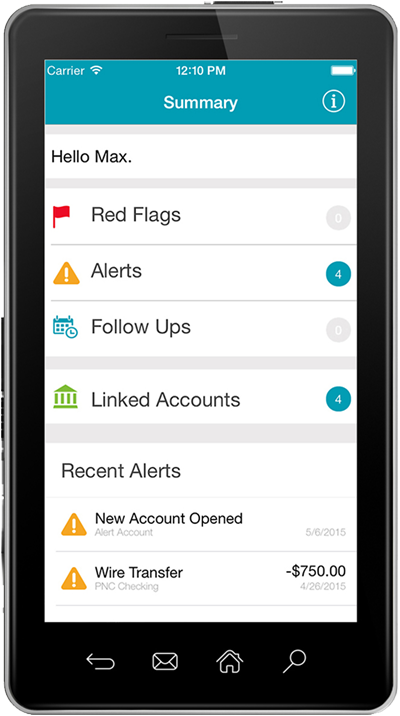

Staying on top of your finances is challenging. Our personalized technology alerts you to signs of irregular activity. Our consolidated dashboard simplifies monitoring across accounts and institutions.

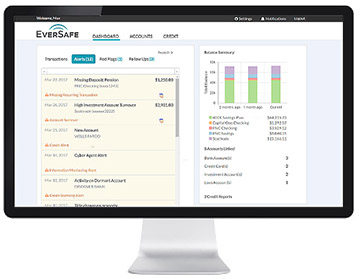

Protect Loved Ones

If you’re caring for a loved one, EverSafe’s exclusive “trusted advocate” feature enables you to serve as an ‘extra set of eyes’ in guarding against identity theft and/or financial abuse—from a distance.

What We Do

A personal detection and alert system, EverSafe stops exploiters in their tracks before a lifetime of savings is depleted. We’re the first step to a good night’s sleep.

![]() ANALYZE

ANALYZE

We examine your historical financial behavior to establish a personal profile. Then we analyze daily transactions to identify erratic activity.

![]() IDENTIFY

IDENTIFY

We look for anomalies like unusual withdrawals, missing deposits, irregular investment activity, changes in spending patterns, late bill payments, and more.

![]() ALERT

ALERT

Suspicious activity alerts are delivered by email, text, phone or the EverSafe App. And EverSafe’s “trusted advocate” feature enables members to designate family, professionals or other trusted individuals to receive alerts and assist in monitoring.

![]() RESOLVE

RESOLVE

EverSafe provides tools to manage the resolution process and helps you create your recovery plan. We’re always just a phone call away.

How We Do It

EverSafe is easy to use and delivers unmatched protection for you, your family, and your clients. No other solution safeguards against scams, fraud, and identity theft better than EverSafe.

![]()

MONITORING WITH PERSONALIZED ALERTS

Our proprietary technology applies enhanced analytics to build a personal profile based on your financial history. When irregular activity is detected our personalized alerts make a real difference in identifying potential scams, fraud or identity theft.

CONSOLIDATED FAMILY DASHBOARD

EverSafe helps you stay on top of your family finances. All accounts. All institutions. All family members. All in one place. Extra bonus—notices about unpaid bills, changes in interest rates, and more.

AN “EXTRA SET OF EYES” FEATURE

According to experts, monitoring is the most critical tool for detecting scams, fraud, and identity theft. EverSafe enables you to designate family members, caregivers, or trusted professionals to receive alerts and assist in monitoring.

SPECIALIZED PROTECTION FOR SENIORS

Developed by experts in aging and fraud, EverSafe’s enhanced algorithms provide deeper protection for seniors. Our age-friendly software supports powers of attorney, guardians, conservators, and trusts.

Has your private information been exposed online?

Try our free scan to see what we can find.